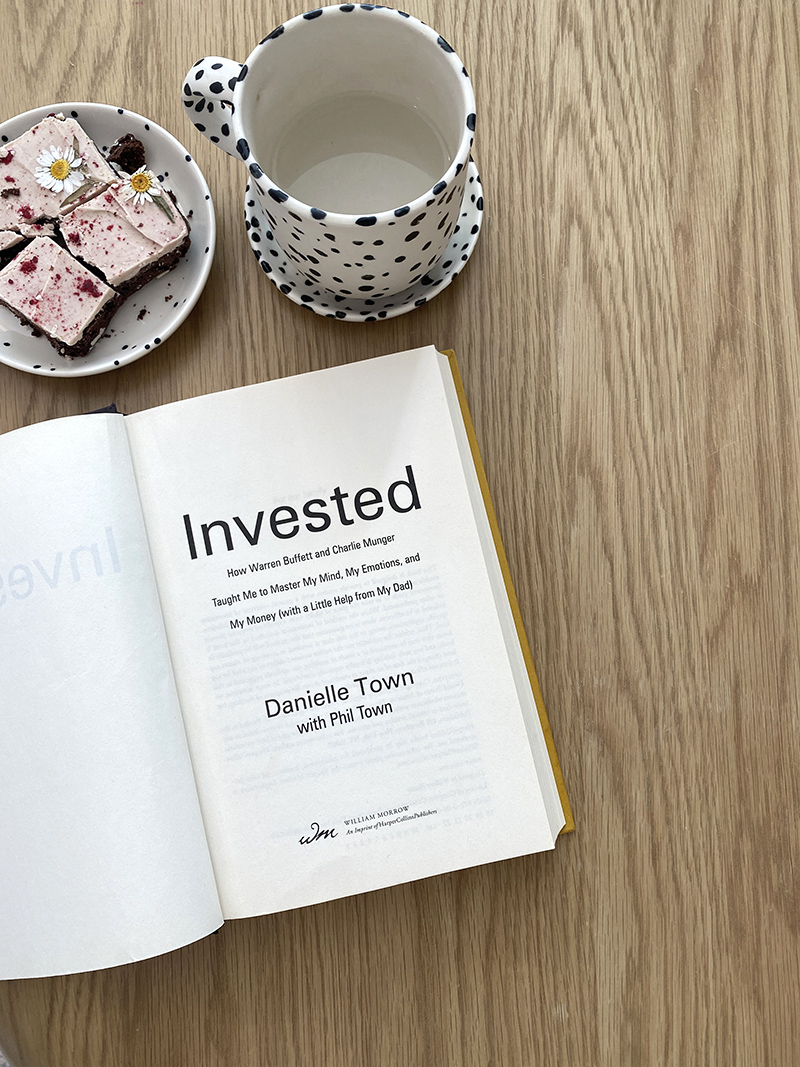

Ceramic Mug and Plates: Franca

Ceramic Mug and Plates: Franca

One of my main goals for 2021 is to learn how to invest. In the last two years, I learned a little bit, but it’s really not enough. I’ve decided to make it a priority to stop letting the topic intimidate me.

Let’s rewind a little bit.

Last year, I started using the Acorns app after a friend recommended it. Every week, I would have $50-$100 withdrawn out of my bank account (the amount varied) and deposited into my Acorns account. Month after month, naturally, the amount started to accumulate. After a full year, I accumulated a decent chunk, but what shocked me the most was that I made a couple of thousand dollars in interest alone.

Now, I realize that to many of you, it’s a: “um… obviously, Helena. That’s what investing is…” However, based on all of the messages that I received, I realized that many of you, like myself, are a bit intimidated by the entire subject.

The Importance of Investing

In the last year, I’ve already learned some key things about investing:

- It’s one of the main ways to make your money work for you.

- Any amount is better than nothing. Whatever you can swing, have a weekly deduction set up.

- It allows you to grow your wealth.

- It generates an additional income stream if needed before retirement.

- Compounding! If you don’t know what compounding is (no shame), I suggest you read the first few paragraphs of this great article. Basically, the interest that I’ve mentioned above starts growing and overtime, interest is accumulating on top of interest! That is major.

Now, this isn’t a post to plug the Acorns app. That’s just one example, but there are many out there. Some work with a Financial Advisor (which I also started to) or with a bank. However, in the book that I’m currently reading, it is mentioned (over and over again) the importance of educating yourself on the topic. This way you’re not necessarily at the mercy of an Advisor and their fees. Like interest, that starts to accumulate to a lot of money over time.

So, here we are. In a focused goal to really educate myself, I turned to my wonderful community on Instagram stories. I asked you all on what books, podcasts or accounts that you’ve found helped to start to understand this topic better. In turn, I hope this post is able to help some of you!

BOOKS:

ElleVest: A Financial Company, For Women By Women

The Warren Buffet Way: Investment Strategies of the World’s Greatest Investor

The Psychology of Money: Timeless Lessons on Wealth, Greed and Happiness

Unshakeable: Your Financial Freedom Playbook

The Intelligent Investor: The Definitive Book on Value Investing

Kiplinger Personal Finance Magazine

YOUTUBE CHANNELS:

PODCASTS:

Bloomberg’s Masters In Business

Bloomberg Opinion columnist Barry Ritholtz looks at the people and ideas that shape markets, investing and business.

Hosted by Emilie Bellet, founder of Vestpod – a digital platform and thriving community that financially empowers women.

Hosted by Glamour Editor-in-Chief Samantha Barry; shares intimate, unscripted stories from women across the country along with advice from financial experts to help guide these women—and women everywhere—forward.

A series asking women to share their salary, their take home pay, and their monthly expenses – which always brings up more questions than answers: Why is she putting so much into retirement? Why can’t she afford a vacation? Why do commenters hate it when diarists let boyfriends pay for the check? In this podcast, the goal is to answer those questions.

ACCOUNTS TO FOLLOW:

A financial company built by women, for women.

NYC Money Expert Becca, sharing personal finance & great deals.

Founded by Haley Sacks, a self-proclaimed financial pop star.

Writer, Speaker + Investing Expert Amanda Holden, teaching women to build wealth.

Millennial Money with Katie, covering spending habits, travel hacking, and simple investing.

19 comments

Anon

I really want to invest but it’s so disheartening when you really don’t have the extra money to spare every month. 😔

February 25, 2021Elena a

Pay yourself first! You are you’re most important bill. Set a fixed amount no matter how small.

February 25, 2021Helena

well said! any amount is bette than nothing! Even $5.

February 25, 2021Marcela

Thank you for sharing this! I too, have tried to learn investments over the past year but I get easily overwhelmed with a lot of the terminology that I just understand. I will check out the resources you listed but I’ve yet to find someone who can explain it on “dummy terms” to me. I have a fidelity account and I’ve played around with it, bought 1 share with little money but I still find it scary. Partly due to that I can’t quite understand it. Hopefully with time it will stick in my brain. Thanks again Helena!!!

February 25, 2021Casey

Marcela, if you have a Fidelity account I suggest setting up an auto investment in FXAIX. I’ve been investing a part of my paycheck in that fund (an S&P 500 index fund) since 2015 and have seen a 90% return. Hope that helps! (I did major in finance so I’m not a total newb when it comes to $!)

February 26, 2021Dee

This is so important! Women don’t learn about this, and it is totally male dominated. I’ve always been a great saver but my money sat in a low interest bank account doing nothing. I’m just starting my journey to understand investing. I’ll be going for passive investing in low cost accumulating exchange traded funds (ETFs) because I have a longer horizon (don’t need the returns till I retire). Having a goal in mind is also important for motivation. One of the things I like, is when you have money put by, at a certain point it gives you freedom not to put up with a bad boss. That’s been liberating for me. So thank you Helena for sharing this post, it is so important that women learn about investing. I always say, women learn how to shop and spend on their appearance, where men learn to invest.

February 26, 2021Ojima

The Financial Diet is a really good account to follow as well

February 28, 2021LIndA P.

Love this post! Im new to investing (and finance in general) and trying to wrap my head about it. I love the Grow your money book from

Clever Girl Finance. Its really helped me understand things – their IG account is great too!

I also recently found and love the bigger pockets money podcast l.

Thank you for sharing this!

March 1, 2021Janine

This is insanely helpful, thank you so much for sharing all these resources! Like you mentioned above, the topic of investing is intimidating me a whole lot if I am completely honest, so this is a very useful Blogpost to refer back to to get started on educating myself! Definitely picking up some of the books mentioned here and checking out a few YouTube channels!

March 2, 2021Xx Janine

https://walkinmysneaks.blogspot.com

ClearPathPackagingUK

Nice and easy article… thanks for sharing!

March 3, 2021Love Spells

A must read post! Good way of describing and pleasure piece of writing. Thanks!

March 6, 2021budget

A must read post! Good way of describing and pleasure piece of writing. Thanks!

March 6, 2021Sol Santos

So many palpable tips! Will definitely tune in to those podcasts on my car rides 🙂 Thank you so much! Love from Lisbon

March 9, 2021Mack

Much obliged for giving such great information. It’s educational. Continue to compose this sorts of incredible article.

March 10, 2021Mayur

Thankyou for writing this blog.It was amazing reading this.

March 18, 2021Karamjit Kaur

Thanks for sharing this informative post.

March 29, 2021BSK Jewellers

Great information… tq for sharing this

April 1, 2021Imarah Marketing PVT LTD

Thanks of your posts,

Imarah Marketing PVT LTD

0332 0444004

Office 106, First Floor, Luxus Mall Gulberg Green Islamabad.

April 12, 2021Teena Sharma

Hello friends if you are planning to visit Goa then I am Teena Sharma professional call girl in goa our tour will be with very beautiful girls . Do you not want to feel joys in the world of love or happiness . now come to visit my websites :-

June 7, 2022